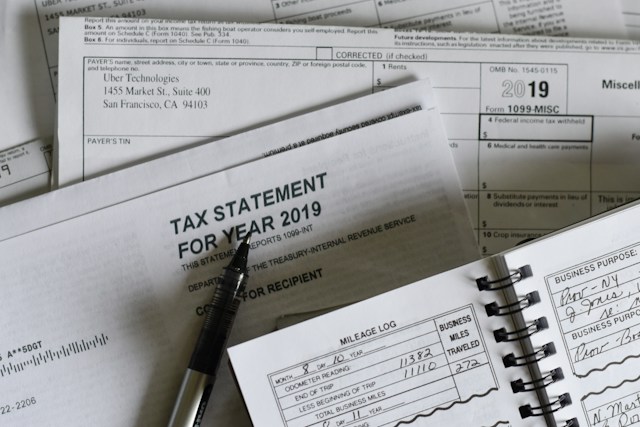

As an entrepreneur, comprehending the intricate world of business taxes is paramount to the financial success of your venture. Understanding the types of taxes, deductions, and credits that apply to your business can help you make informed decisions, maximize savings, and ensure compliance with tax regulations.

Types of Business Taxes

Business taxes can take various forms, depending on your business structure and location. Here are some of the most common types:

- Income Tax: The core of business taxation, income tax is levied on your business’s profits. The structure of your business, whether a sole proprietorship, partnership, S corporation, or C corporation, determines how you report and pay income tax.

- Self-Employment Tax: Sole proprietors, partners, and LLC members may be subject to self-employment tax, covering Social Security and Medicare. It’s essential to calculate and remit this tax as part of your financial responsibilities.

- Employment Taxes: If you have employees, you’ll need to withhold and pay payroll taxes, including Social Security, Medicare, and federal income taxes. Understanding the intricacies of employment tax is vital to meet your obligations.

- Sales Tax: Some states impose a sales tax on the purchase of goods and services. Complying with sales tax regulations is particularly important for businesses engaged in retail or service industries.

- Property Tax: If you own property, such as real estate or vehicles, you may be subject to property tax. Property tax laws vary by location and asset type.

Tax Credits

Tax credits directly reduce your tax liability, making them a valuable tool for cost savings. Some notable tax credits for entrepreneurs include:

Small Business Health Care Tax Credit: This credit helps small businesses provide health insurance to employees, offsetting a portion of the premium costs.

Research and Development (R&D) Tax Credit: If your business is engaged in qualifying research and development activities, you may be eligible for this credit, encouraging innovation.

Deductions and Write-Offs

Deductions are a lifeline for businesses looking to reduce their taxable income. Some common deductions include:

- Office Expenses: Costs associated with running your office, such as rent, utilities, and office supplies, are often deductible.

- Employee Salaries: The salaries and wages you pay to employees are typically tax-deductible as business expenses.

- Advertising and Marketing: Funds spent on advertising and marketing campaigns can be written off as deductions.

- Depreciation: Under the Section 179 deduction, you can deduct the cost of certain assets (like equipment and machinery) in the year they were purchased, rather than spreading the deduction over several years.

Quarterly Estimated Taxes

The quarterly estimated tax system is designed to help entrepreneurs maintain better control over their financial responsibilities and cash flow. By spreading tax payments throughout the year, businesses can avoid the stress of accumulating a substantial year-end tax bill and set aside the necessary funds in a systematic manner. This practice not only ensures that tax obligations are met but also promotes better financial planning and management.

In addition to avoiding penalties and interest charges, timely quarterly estimated tax payments provide entrepreneurs with the peace of mind that they are in compliance with tax laws, allowing them to focus on growing their businesses without the looming concern of a hefty tax bill

Compliance and Reporting

Fulfilling your tax obligations is not only a financial matter but also a legal requirement. Accurate reporting of income, expenses, and deductions is crucial.

Whether you’re a sole proprietor, small business owner, or part of a larger corporation, the importance of precise financial reporting can’t be overstated. It’s wise to consult with tax professionals or accountants who can provide expert guidance and ensure that your business adheres to all applicable tax regulations, safeguarding your financial standing and reputation.

Tax Planning

Effective tax planning involves strategizing to minimize your overall tax burden. Collaborating with a tax professional can help you identify tax-saving strategies, deductions, and credits that are applicable to your business, ultimately optimizing your financial position.

Comprehensive tax planning ensures that your business operates efficiently and is financially prepared to meet its tax obligations while capitalizing on opportunities to retain more of your hard-earned revenue. It’s a valuable strategy that not only reduces your tax burden but also contributes to the financial stability and growth of your business.

Business Structure Implications:

Your business structure, whether a sole proprietorship, partnership, LLC, S corporation, or C corporation, has a significant impact on your tax obligations. Understanding the implications of your chosen structure can help you make informed decisions and minimize your tax liability.

Navigating business taxes is a fundamental aspect of entrepreneurship. By comprehending the various types of taxes, deductions, and credits, you can make informed decisions that support your business’s financial health. It’s essential to stay updated on tax regulations and, when in doubt, seek professional guidance to ensure compliance and maximize savings.